RBI spent $12 billion to not let Re breach 89 level in October

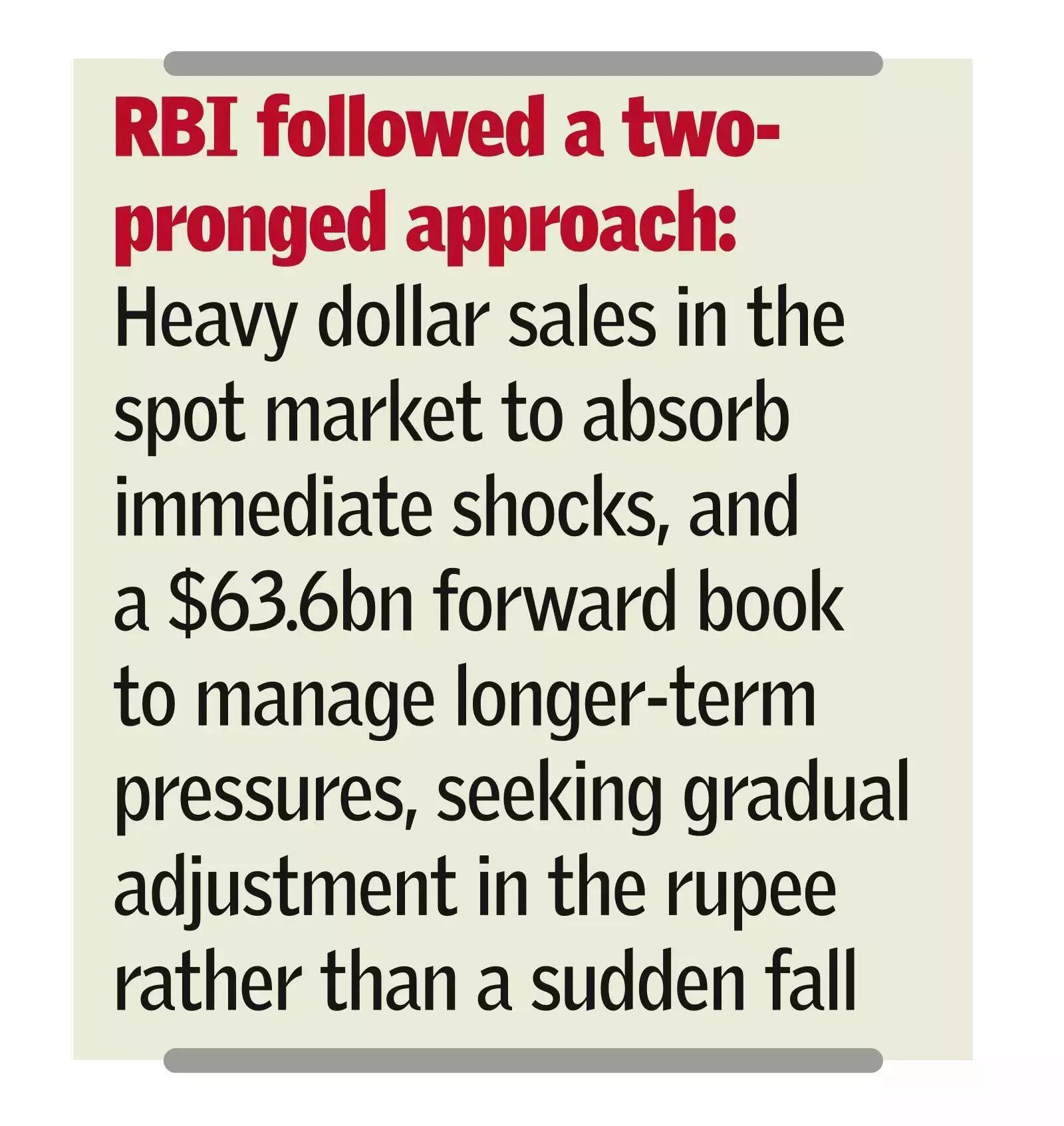

MUMBAI: RBI sold a net $11.9 billion in Oct 2025 to support the rupee, reinforcing its role as the stabilising force in the currency market. Data from RBI’s Dec bulletin shows that the central bank stayed active across both spot and forward markets through FY25 to reduce volatility and keep market conditions orderly.In the spot, or OTC, market, the RBI sold more dollars than it bought to provide liquidity. Gross dollar purchases jumped sharply by 704% to $17.7 billion in Oct from $2.2 billion in Sept. At the same time, gross dollar sales rose 192% to $29.6 billion. This led to net dollar sales of $11.9 billion in Oct, a 50% increase from $7.9 billion in Sept, showing stronger intervention to counter pressure on the rupee. Taken together, RBI’s cumulative net dollar sales in FY25 up to Oct stood at $34.5 billion, or Rs 2,91,233 crore at contract rates.

Alongside spot market action, RBI relied more on forward contracts to influence future expectations without immediately using up reserves. By end-Oct, outstanding net forward sales increased 7.1% to $63.6 billion from $59.4 billion at end-Sept. This larger forward position acts as a buffer, reassuring markets that dollars will be supplied in the future if needed.In the exchange-traded currency futures market, RBI kept its net position neutral. In Oct, it bought and sold $2.3 billion each, resulting in no net purchase or sale. Even so, trading activity rose sharply, with total volumes up 73.5% from Sep. Outstanding net futures sales declined 9.8% to $1.4 billion by end-Oct.The data also suggest RBI was defending the rupee from dropping to 89 levels. The effective intervention price in Oct worked out to around Rs 88.25 per dollar, only slightly lower than Rs 88.35 in Sept, despite the large rise in the amount of dollars sold. This points to efforts to keep the rupee from weakening beyond the Rs 89 mark during a volatile period. For comparison, the average intervention rate for FY25 up to Oct was lower, at about Rs 84.39/$, reflecting the rupee’s broader depreciation in late 2025 amid trade tensions and capital outflows.