Weight-loss therapy set to push pharma growth

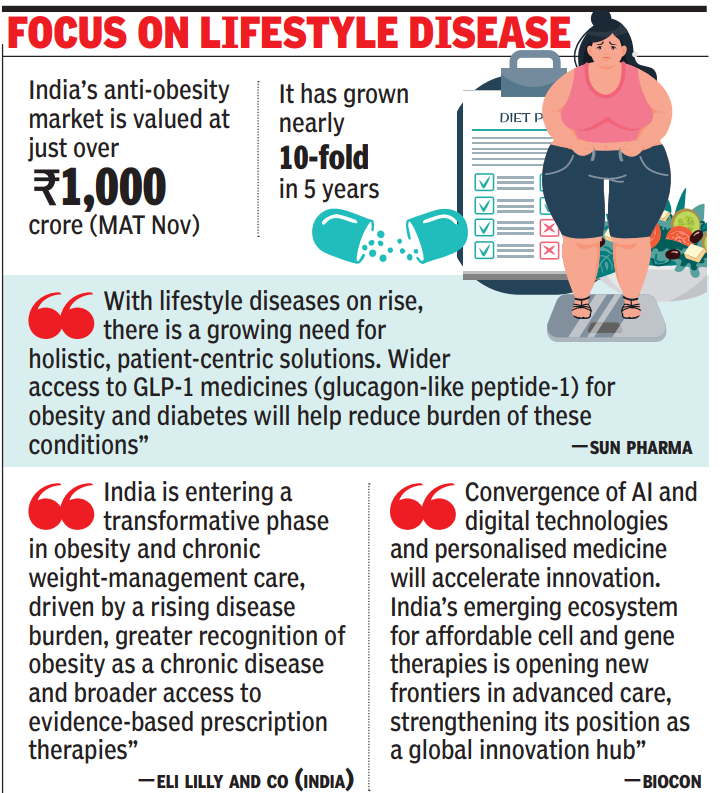

NEW DELHI: Once relegated to the fringes of lifestyle care, obesity drugs have emerged as one of the world’s most powerful growth sectors, ranked by McKinsey alongside AI, EVs and robotics as trillion-dollar opportunities by 2040. In India, the surge in the weight-loss and metabolic therapy market is set to shape pharma’s growth narrative in 2026 as affordable generics loom. Rising AI adoption across drug discovery will accelerate innovation and shorten time-to-market, while certain companies pivot from simple to niche and complex generics. Says Kirti Ganorkar, MD Sun Pharma: “With lifestyle diseases on the rise, there is a growing need for holistic, patient-centric solutions. Wider access to GLP-1 medicines (glucagon-like peptide-1) for obesity and diabetes will help reduce the burden of these conditions.”Winselow Tucker, president and GM, Eli Lilly and Co (India) said: “India is entering a transformative phase in obesity and chronic weight-management care, driven by a rising disease burden, greater recognition of obesity as a chronic disease, and broader access to evidence-based prescription therapies. Recent industry developments underscore strong patient demand and an expanding range of treatment options aimed at improving access and outcomes.” With nearly 100 million adults living with diabetes and rising obesity-linked conditions, India’s anti-obesity market, valued at just over Rs 1,000 crore (MAT Nov), has grown nearly 10-fold in five years. Blockbuster therapies – Wegovy and Mounjaro, marketed by Novo Nordisk and Eli Lilly respectively, were launched at “India-specific prices” earlier this year, while global bestseller Ozempic recently made its India debut.

“Despite rising demand, India’s obesity market remains largely under-penetrated, offering significant headroom for both innovators and generic entrants,” Sheetal Sapale, vice-president (commercial) at Pharmarack said.Entry of low-priced generics from March after semaglutide (key ingredient in the blockbuster weight-loss jab) loses patent protection, along with potential price cuts by innovators, is expected to further accelerate growth in the fastest growing therapy. Bhanu Prakash Kalmath SJ, healthcare industry leader, Grant Thornton Bharat adds: “The focus is clearly moving toward drugs such as GLP-1 therapies, alongside digital health solutions and preventive lifestyle programmes. In near-term, deeper partnerships among pharma companies, consumer health players and digital platforms are expected to play a role in improving access beyond major urban centres.” In parallel, companies are ramping up AI-led investments across the value chain to boost R&D productivity, improve efficiency and sharpen commercial outcomes. Says Kiran Mazumdar-Shaw, executive chairperson, Biocon: “The convergence of AI and digital technologies and personalised medicine will accelerate innovation. At the same time, India’s emerging ecosystem for affordable cell and gene therapies is opening new frontiers in advanced care, strengthening its position as a global innovation hub. The continued expansion of biosimilars and complex biologics will further democratise access to cutting-edge treatments worldwide, while the rapid growth of CRDMOs will establish India as a preferred destination for high-value outsourcing in an era of supply-chain reconfiguration.”

Domestic pharma is scaling up R&D, particularly for advanced biologics, GLs, antibody-drug conjugate, cell and gene therapies, and pivoting from simple to complex generics, according to Srikanth Mahadevan, director, Deloitte India.Further, “private equity interest will remain a dominant theme for healthcare providers, particularly hospitals, medical services and digital health. At the same time, there is a growing push towards non-US markets to diversify risk and reduce reliance on the US generics business,” Sujay Shetty, global health industries advisory leader, PwC India says.