Tariff tantrums: Exporters brace for uncertain times

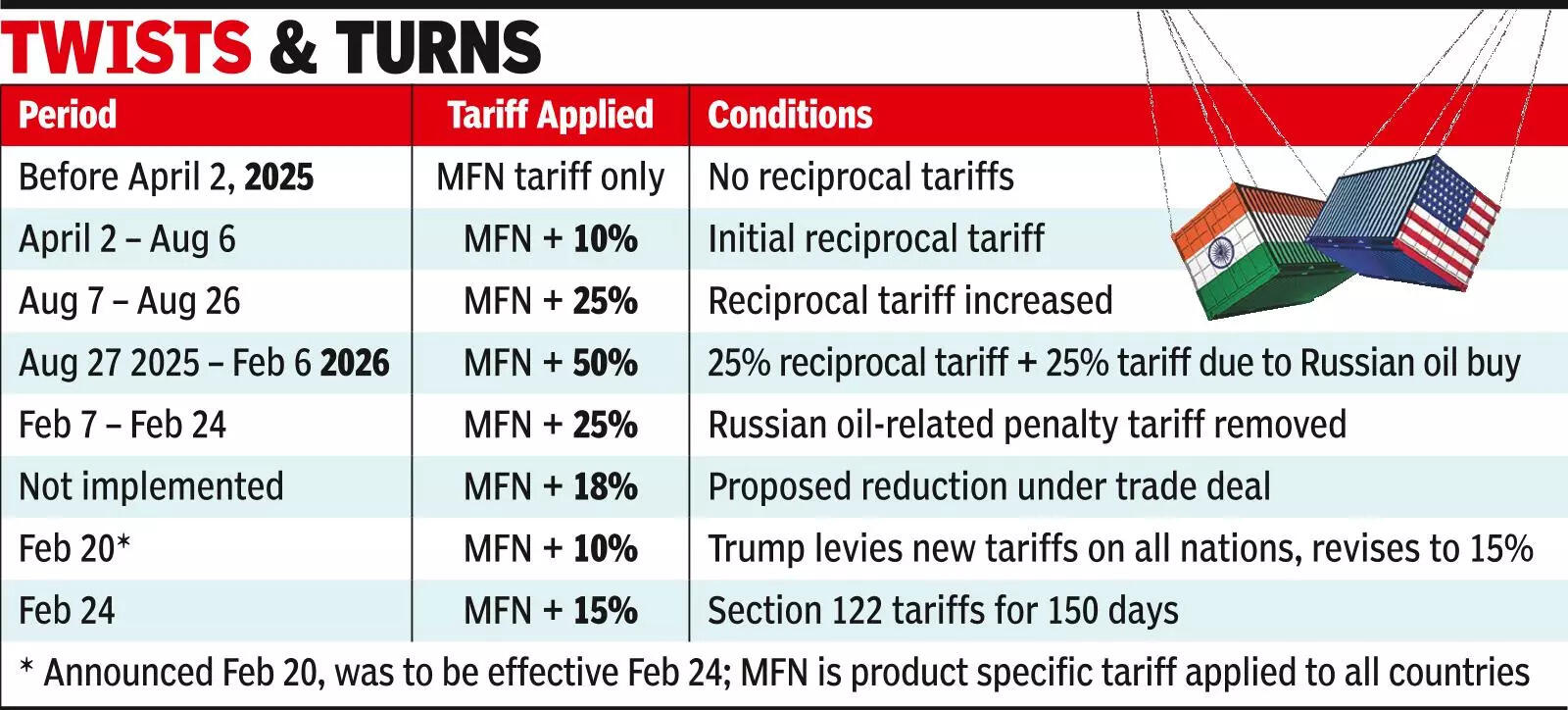

NEW DELHI: A leading exporter left work on Friday with additional US tariffs on most goods from India at 25%. He was hoping it will fall to 18% this week. Late evening, the US Supreme Court declared the imposition of reciprocal tariffs illegal and by Saturday a new levy of 10% kicked in, which moved to 15% by evening.“Indian exporters were on tenterhooks for the last three quarters as we were offering very heavy discounts to retain US business. We knew our govt was working on a bilateral trade deal. The US economy’s resilience is the only help that mitigated these effects, but one thing is very clear, that inconsistency in US tariff policies is new normal for now,” said Pallab Banerjee, MD of Pearl Global, a leading garment maker.Over the last 10 months, they have seen multiple changes and most businesses are bracing for more twists and turns as the current tariffs are in place for 150 days.

Inconsistent Policies In US Seen As ‘New Normal’

Most exporters are happy with uniform tariffs over the MFN or product specific rate and having dealt with discounts of as much as 15-18% when Trump had slapped 50% levy on India, discounts are something that they are willing to live with. Against discounts of 15-18% when the punitive tariffs of 50% were in place for Indian exports, the discounts had dropped to 0-3% after the trade deal was announced on Feb 2. Now, many exporters fear that US buyers will seek a three-way split, which means a discount of up to 5%.“The 10% tariffs were good, we were all smiling, but then it changed within a few hours. This is temporary. We will get to know what happens when offices open (in the US on Monday),” said Jyoti Apparels MD HKL Magu, an industry veteran.“The frequent tariff changes impact businesses, particularly retailers and brands, who will continuously need to recalibrate their cost calculations and negotiate or renegotiate with suppliers,” said Banerjee. Footwear industry players believe level-playing field is good for Indian businesses. “It is good. Coming from a higher duty to lower will not make much difference,” said Israr Ahmed, director at Farida Group, a large leather and footwear exporter.“Recent clarity provided by the US Supreme Court ruling has improved visibility for global footwear and leather sourcing, with effective duties now expected to fall in the 10-15% range, a more favourable outcome than earlier. The ruling applies uniformly across Asian sourcing countries, helping restore predictability for US brands,” added Florence Shoe Company chairman Aqueel Panaruna.The elephant in the room is China, which is a major gainer from the fallout of the US Supreme Court ruling. Against additional tariffs of well over 30% on most products, it will pay less than half the rate and tariff-wise, be at par with competitors.