Donald Trump’s tariff gamble: Who blinked, who pushed back & did it ‘make America great again’?

“The golden age of America begins right now,” Donald Trump declared as he launched his second stint in the White House. Back in the presidency, he wasted no time signaling that this term would be markedly different from his first.

Trump’s biggest leverage this time: tariffs. Unlike before, trade would no longer be managed quietly through negotiations and frameworks—it would be enforced.

In less than a year, MAGA supremo has turned tariffs into the central weapon of American foreign policy, unsettling allies, pressuring rivals and forcing governments across continents to recalculate their economic strategies. What began as an effort to “put America first” has since evolved into a global stress test — of markets, diplomacy and America’s own economy.Moments after taking office in January, Trump made it clear that America’s trading partners would now operate on his terms. He revived a belief he has held for decades: that tariffs are not merely economic instruments, but levers of power — tools to extract concessions, reshape behaviour and reassert US hegemony, with his doctrine of “Make America Great Again”.That philosophy has defined the year 2025. Tariff rates have been announced, escalated, rolled back and reintroduced, often with little notice, keeping governments, markets and businesses on edge. In some cases, the pressure has produced partial deals. In others, it has hardened resistance. In almost all, it has altered the tone of global trade.Trump has justified the approach as part of a broader mission to revive American manufacturing, reduce trade deficits and protect domestic industry. But the scope of his actions has extended far beyond economics. Trade policy has become inseparable from his views on geopolitics, alliances and conflict, particularly the war in Ukraine and his simmering frustrations with Russia.That convergence is visible in how Trump has treated different countries. Large emerging economies such as China and India have faced some of the sharpest measures, often accompanied by rhetoric linking tariffs to security, energy purchases or geopolitical alignment. Neighbours Canada and Mexico have been pulled into tariff standoffs over migration, water disputes and regulatory issues. Venezuela has been targeted with sweeping secondary sanctions. Countries seen as cooperative, meanwhile, have often received exemptions, pauses or negotiated ceilings.

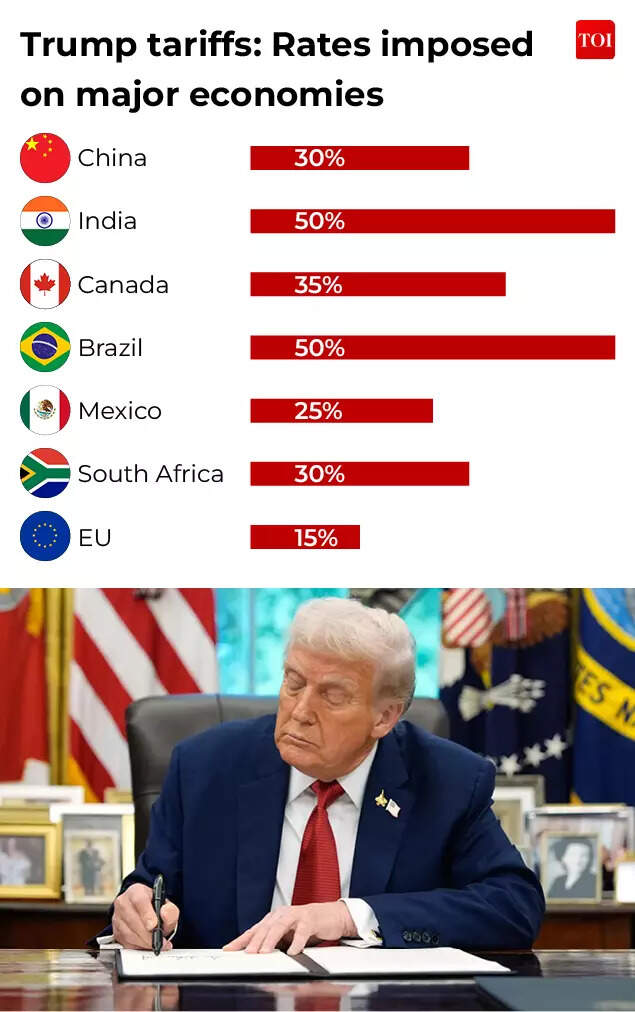

However, he has been noticeably more restrained toward countries that have eagerly echoed Trump’s rhetoric, showered him with the praise he craves, and even gone so far as to nominate him for a Nobel Peace Prize.The numbers underline the scale of the shift. According to the Yale Budget Lab, the average US tariff rate has climbed to nearly 17%, up from under 3% at the end of 2024. The measures now generate roughly $30 billion a month for the US Treasury, a revenue stream the administration has openly touted.The global response has been swift. As CNBC reported, leaders from Europe to Asia have made repeated trips to Washington seeking carve-outs, exemptions or negotiated limits, often in return for promises of new investment on US soil. Framework agreements have been reached with partners including the European Union, the United Kingdom, Switzerland, Japan, South Korea and Vietnam. Yet the most consequential relationships, with China and India, remain unresolved.

China

In April, it began with a jolt: Trump imposed a 104% tariff on Beijing, a decision announced by White House press secretary Karoline Leavitt.Trump’s renewed tariff war opened with a heavy hand on China, rolling out a startling 145% duty on Chinese goods. Beijing hit back swiftly with a 125% tariff on US products, escalating the tug of war between the world’s two biggest economies. But the shock phase was short-lived. Within months, Washington softened its stance and scaled the tariff down to 30%, with further negotiations now under way.

Trade war: Trump vs Xi

Yet China, the United States’ biggest economic rival, absorbed the blow. Beijing’s trade surplus defied Trump’s tariff shock, climbing past a trillion dollars as China diversified away from the US, moved its manufacturing sector up the value chain, and relied on its strategic dominance in rare earth minerals, crucial to Western defence and technology, to push back against pressure from Washington and Europe.Chinese exports have remained resilient despite a 55% levy on shipments to the US, suggesting Beijing still has room to absorb more pain. For Trump, escalating the confrontation risks provoking Chinese curbs on rare earth supplies that are vital for American production of everything from smartphones to missiles.Tensions rose further on October 9, when Beijing expanded export controls to include 12 of 17 rare-earth metals and key refining equipment, effective December 1. China accused Washington of harming its interests and souring the atmosphere of trade talks. Earlier, Beijing criticised Trump’s tariff threats as “double standards” after he warned of an additional 100% duty in response to China’s curbs on rare earth exports.Despite frequent flare-ups, neither side can afford an escalated dispute, it would be a tightrope for both economies. Negotiations continue. Xi Jinping and Donald Trump met in October, with plans for more meetings ahead.

Our relationship with China is extremely strong.

Donald Trump

Their discussions in South Korea covered trade, Taiwan, Russia’s invasion of Ukraine, and the fentanyl crisis, according to both governments.The tug of war between Washington and Beijing is far from over. Efforts to stabilise ties loom large, especially as a tentative detente reached this year expires in late 2026. Trump and Xi are expected to meet twice next year as both sides try to prevent the world’s two biggest economies from sliding into a deeper confrontation.

Canada and Mexico

Canada and Mexico, America’s closest neighbours, have endured a year of strained relations under Trump. His long-standing complaints over drug trafficking, migration, water disputes and trade imbalances resurfaced forcefully, this time backed by tariff threats.For Canada, the impact has been severe. In March, the US slapped a 25% tariff on Canadian goods, later raising it to 35%, with an additional 10% looming. Prime Minister Mark Carney, then new in office, found himself grappling with the steepest US trade restrictions in decades.On February 1, Trump signed executive orders imposing 25% tariffs on all Mexican and Canadian goods, except Canadian oil and energy exports, which faced a lower 10% rate. The move threw North American supply chains into turmoil.The US has since issued a list of demands for restoring freer trade with Canada: opening its dairy market, removing penalties on American digital platforms under Canada’s Online Streaming Act, and lifting provincial bans on US liquor. The demands were spelled out by US Trade Representative Jamieson Greer as part of an ongoing USMCA review.Canada has also been hit by additional Section 232 tariffs on steel, aluminium, autos, copper and wood, a revival of Trump’s first-term playbook.Mexico, meanwhile, faced a 30% tariff from August 1 after trade negotiations stalled. Trump later added another 5%, accusing Mexico of violating a cross-border water treaty.

Mexico continues to violate our Water Treaty, seriously hurting our beautiful Texas crops.

Trump wrote on Truth Social

Mexico’s economy remains deeply integrated with the US, with more than $1 billion in daily bilateral commerce. Mexico’s recently imposed 50% tariff on India has been widely interpreted as a move influenced by pressure from Washington, and an attempt to stay aligned with the US ahead of the next USMCA review.Mexico and Canada already faced tariffs before this year’s reciprocal move, 25% and 35% on goods outside the USMCA, which is due for review in 2026.

India

Trump’s relationship with Prime Minister Narendra Modi has often appeared warm. The US President has repeatedly spoken of his bond with PM Modi, calling him a “great friend.” But his trade policy toward India tells a very different story.On August 1, the US imposed a 25% tariff on Indian goods, doubling it to 50% by August 27, along with an additional “penalty” linked to India’s ties with Russia. Trump accused India of maintaining some of the world’s highest tariffs and “obnoxious” non-monetary trade barriers, while also buying large volumes of Russian oil at a time when, as he put it, “everyone wants Russia to stop the killing in Ukraine.”His sharpest remark came in July: “I don’t care what India does with Russia. They can take their dead economies down together, for all I care.”

India pushed back firmly. Union commerce minister Piyush Goyal rejected Trump’s description of India as a “dead economy”, asserting that despite the hurdles imposed by the US administration, the country remained on track to become the world’s third-largest economy.“We have risen from the 11th largest economy to one of the top five economies driven by our reforms, the hard work of our farmers, MSMEs and entrepreneurs. It is widely expected that we will become the third-largest economy in a few years,” he said.

India’s exports to the US did fall sharply after the tariff hikes, dropping 28.5% between May and October 2025. Yet, in a notable turnaround, overall exports surged 19.4% in November to $38.1 billion, with shipments rising not only to China but also to the US.

Despite the tariffs, we have been able to hold our exports.

Commerce secretary Rajesh Agrawal

Brics

Trump has repeatedly cast Brics as a threat to the dollar, claiming the bloc was “set up to hurt us.” He has warned that any country aligning with Brics would face tariffs from the US.“I told anybody who wants to be in Brics, that’s fine, but we’re going to put tariffs on your nation,” Trump said. He has repeatedly argued that Brics was designed to promote “de-dollarisation”, weaken the Bretton Woods system and dilute American influence.

Yet the reality has moved in the opposite direction. Brics has expanded from five members to ten — Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, the UAE and Indonesia — with ten more designated as partner states. Several others, including Pakistan and Sri Lanka, have applied to join.The expansion has clearly unsettled Washington. Trump has insisted countries are “dropping out” of Brics, but the bloc has continued to grow, underscoring the limits of tariff threats as a deterrent.

Brazil

Trump’s tensions with Brazilian President Luiz Inácio Lula da Silva — and his open support for former leader Jair Bolsonaro — shaped Washington’s trade posture toward Brazil this year.The US imposed a 40% tariff on Brazilian goods, later raising total duties to 50%, citing threats to US national security. The move was widely seen as political as much as economic, particularly amid Trump’s criticism of Brazil’s judiciary and its handling of Bolsonaro-related cases.By November, however, the White House began to retreat. Facing rising domestic food prices, Trump rolled back tariffs on Brazilian beef, cocoa, coffee and fruit, mirroring similar reversals elsewhere as inflation concerns mounted at home.After failing to influence Brazil’s judicial process, Trump was compelled to engage directly with Lula’s government, softening some of the earlier punitive measures.

Venezuela

Trump’s crackdown on Venezuela has been among the harshest of his second term. He declared that any country purchasing Venezuelan oil or gas would face a 25% tariff on all trade with the US, a sweeping “secondary tariff” aimed largely at China, Venezuela’s biggest customer.

Last week, Trump ordered a “complete blockade” of tankers moving in and out of Venezuelan waters, choking off what remains of the country’s oil lifeline.Trump has accused President Nicolás Maduro of sending migrants, criminals and drug traffickers into the US, claims he has offered no evidence for. US warships now patrol the region, and clashes at sea have resulted in fatalities.Venezuela, home to the world’s largest proven oil reserves, now accounts for less than 1% of global output — a collapse deepened by years of sanctions and reinforced by Trump’s latest measures.

US economy under pressure

For now, the golden age remains elusive.Trump campaigned on reviving industry, lowering prices and creating jobs “like never before.” But the economic record under his tariff-heavy approach has been mixed.Manufacturing employment has barely grown since January, with factory jobs increasing in only two out of ten months this year. At the same time, the abrupt tariff hikes triggered price pressures across several sectors, from automobiles to consumer goods.The White House itself has acknowledged the strain. “More painful than I expected,” chief of staff Susie Wiles conceded, reflecting internal concerns over the pace and scale of the rollout.Economists remain divided on whether Trump’s tariffs will cause a temporary spike in inflation or lead to more persistent price rises. The Federal Reserve has been weighing the impact for months, factoring trade uncertainty into its policy outlook.Sensing political risk, the administration has begun easing some of the pressure. Tariffs on select agricultural imports, including beef, tomatoes, coffee and bananas, have been lowered, while a $12 billion aid package for farmers has been announced. Discussions on stimulus checks funded by tariff revenues have also surfaced.

Where this leaves the world

In less than a year, Trump has reshaped the global trading system, unsettling allies, pressuring adversaries and attempting to rewire America’s place in the world through tariffs rather than treaties.But as India and China push back, Brics expands and the US economy absorbs tariff-induced strain, the limits of this strategy are becoming clearer.Trump’s strong alignment to his MAGA doctrine will restore American strength and manufacturing might. It risks isolating the US and accelerating the very multipolar shift he set out to prevent.For now, the outcome remains uncertain. What is clear is that global trade has entered a more volatile phase, one shaped as much by political calculation as by economic logic.The larger question, still unanswered, is whether Trump’s tariff wars are restoring American primacy, or hastening the rise of a world no longer willing to bend to Washington’s terms.