Income tax refund: Your refund may be delayed if revised return not filed by December 31, 2025 deadline – here’s why

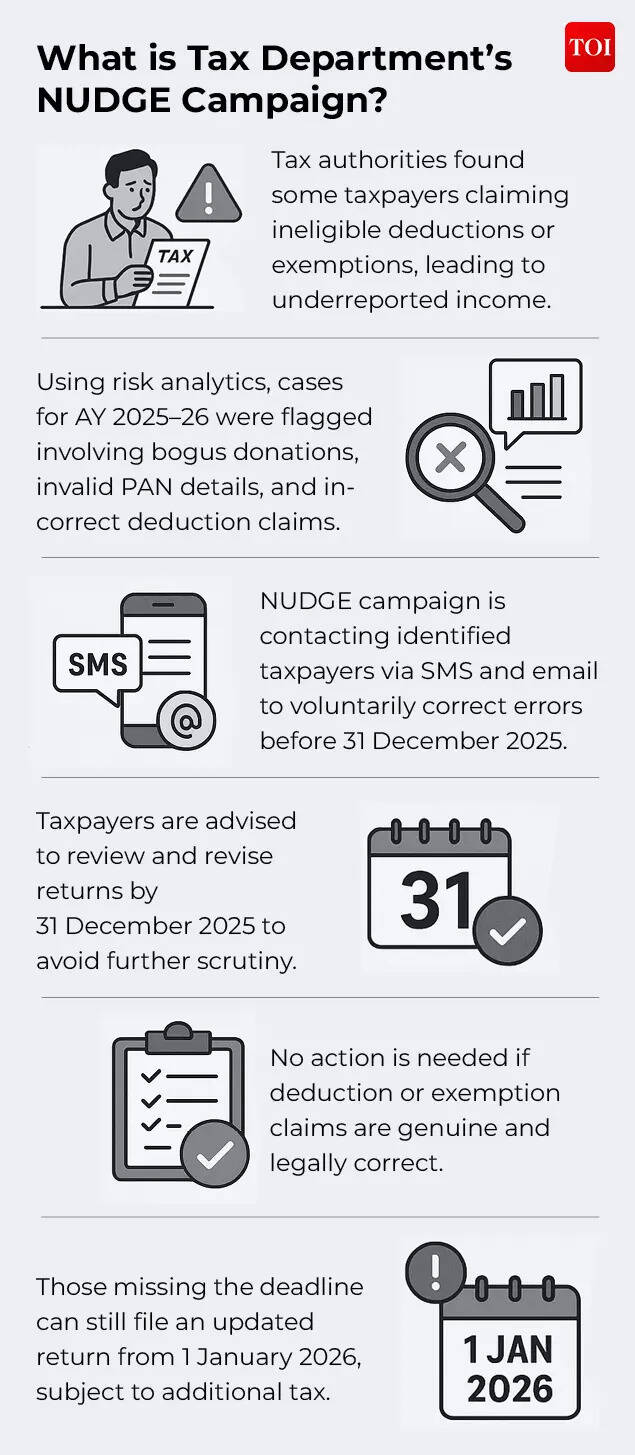

Income tax refund status: The Income Tax Department has stepped up scrutiny for tax returns and several taxpayers have not received their income tax refunds this year. The delay in tax refunds is a result of greater vigilance on tax deductions and exemptions that have been claimed by taxpayers.Ahead of the December 31, 2025 deadline for filing an updated or belated return, the Income Tax Department has also launched a NUDGE (Non-intrusive Usage of Data to Guide and Enable) campaign, urging taxpayers to file updated tax returns since their exemptions, deduction and refund claims have been found to be ineligible.

ITR December 31, 2025 Deadline Important For Tax Refunds

According to an ET report, the income tax refunds for those taxpayers may face a delay if they fail to file a revised Income Tax Return by the December 31, 2025 deadline for Assessment Year 2025-26, particularly in cases where errors or missing information have resulted in incorrect refund claims or data mismatches.The Income Tax Department has begun sending emails and SMS to taxpayers who have claimed what the tax department has called ‘ineligible’ deductions or exemptions they are not entitled to. These taxpayers have been asked to correct the errors if any, and submit a revised return by December 31, 2025.Also Read | ITR filing: Received ‘nudge’ from Income Tax Department for tax return & refund claims? Here’s what you need to do The December 31, 2025 deadline is significant as it marks the last date for filing both revised and belated income tax returns. Once a return is processed by the Centralised Processing Centre, any discrepancies or mistakes that are flagged and communicated to the taxpayer will invite detailed scrutiny. However, if the return is processed only after the deadline, the intimation highlighting the error may also be received after December 31, leaving the taxpayer without the option to revise the return, the ET report said.As a result, taxpayers whose returns contain mistakes that are identified after the deadline may have to face further verification or assessment proceedings, even if the error was unintentional.

Nudge Campaign

Chartered Accountant Suresh Surana was quoted as saying, “Accordingly, once this date has elapsed, a taxpayer can no longer revise the return of income to correct errors or omissions, even if the return has not yet been processed by the Centralised Processing Centre.”Income tax refunds are at the risk of being delayed for taxpayers who fail to file a revised Income Tax Return by the December 31, 2025 deadline, particularly salaried employees whose tax filings contain mismatches with employer records.Abhishek Soni, CEO & co-founder, Tax2win, said many salaried individuals have received intimation notices from the Income Tax Department. These cases largely involve employees who claimed deductions such as those under Sections 80C, 80D or House Rent Allowance in their returns but did not disclose these claims to their employers at the time tax was deducted at source.Maneesh Bawa, Partner, Nangia Global, noted that these mismatches are common and can occur when tax has been deducted under the new regime, but the return is filed under the old regime with deductions claimed.Jigar Suba, founder of JC Suba & Associates told ET that such intimations may be triggered by a range of errors, including incorrect or excessive deduction claims, mismatches in income reported against data reflected in the Annual Information Statement or Tax Information Summary, and discrepancies between the Income Tax Return and Form 26AS. Other common reasons include incorrect House Rent Allowance or leave travel claims, unsupported deductions for life or medical insurance, and ineligible donations claimed for charitable trusts or political parties.He added that failure to disclose income beyond salary is another major trigger, with omissions often relating to the sale of mutual funds, equity shares, crypto assets, as well as other capital gains or interest income.Abhishek Soni said that such intimations are significant as they indicate that the Income Tax Department has identified a mismatch in the return and that its data does not fully support the deductions claimed. He warned that ignoring the notice could result in tax demands, interest liabilities or further communications from the department.Maneesh Bawa said that if the Income Tax Department has identified an error, taxpayers should file a revised return within the permitted timeline, which is currently open until December 31, 2025. He cautioned that ignoring a genuine discrepancy may lead to disallowance of claims and could invite closer scrutiny, resulting in additional tax liabilities along with interest and penalties.