India calmest stock market, traders run out of ‘options’

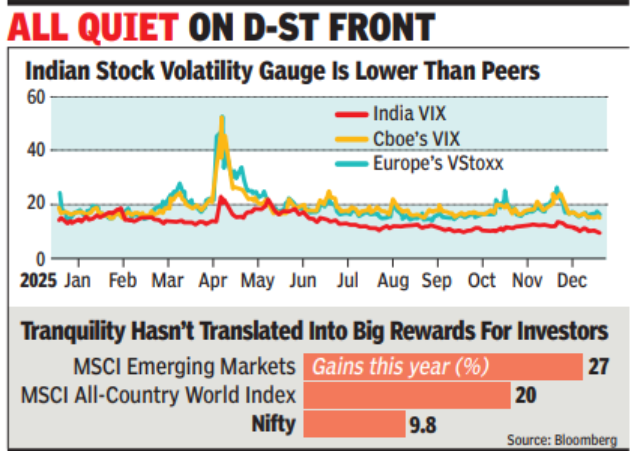

India’s stock market has become one of the calmest in the world – so calm that it’s prompting a rethink of strategies among players in the country’s vast derivatives space.Despite geopolitical flare ups and a recent global selloff in risk assets, Nifty has barely budged for months as domestic money overwhelms foreign flows and derivatives trading curbs choke off volatility. The India NSE Volatility Index, a gauge tracking expectations for future swings, ended Friday at an all-time low.

For the traders powering the world’s largest options market by volume, that’s making it harder to profit from the well-known strategies. Volatility is the engine of derivatives trading: when markets swing, investors pay up to hedge, and the cost of contracts rise. When stocks are calm, premiums shrink, eroding returns for option sellers and leaving traditional strategies less profitable.“The market has become more efficient and competitive – that’s meant lower returns for standard vol-selling strategies,” said Nitesh Gupta, partner and derivatives trader at Karna Stock Broking. “In this environment, trading desks will have to increase risk to make better returns.”A turning point came last year, when Sebi launched a sweeping crackdown aimed at curbing speculative retail activity and addressing losses among individual traders. The markets regulator scrapped several popular weekly options, cutting out the very products that had amplified intraday swings and drying out volume.The impact is clear: While activity has bounced off from a low in Feb, notional turnover has averaged almost Rs 240 lakh crore ($2.7 trillion) a day this year, down 35% from 2024. It’s the first annual decline since data going back to 2017.That drop in derivatives activity has fed back into the underlying market: Nifty has moved less than 1.5% for 151 consecutive sessions, a run that’s nearing a record set in 2023, and its three-month realised volatility has slipped toward 8 points – lower than in any major global market. (This is a Bloomberg story)